A HOLISTIC APPROACH TO WEALTH

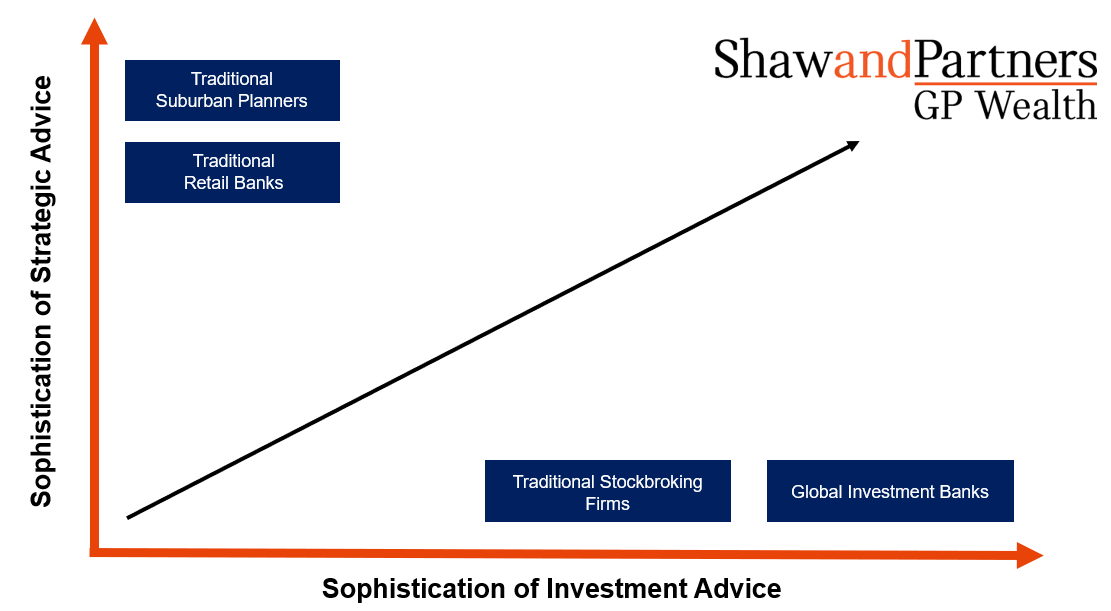

Many advice offerings in the Australian market are limited with respect to the breadth of services and advice they provide, typically only focusing on either financial planning or investment advice, as represented by the below.

The GP Wealth team have a fundamental belief that each individual and family will require sophistication and specialisation across both strategy and investment advice at some point along their wealth journey.

Our advisory process is designed to combine these two areas of advice to produce a highly sophisticated wealth offering, aimed at delivering tailored solutions to grow and preserve our clients wealth.

Supporting us we have an expert team of investment strategists and research analysts who share knowledge and insight so that our clients receive access to a coordinated and integrated solution.

We believe this combined and collaborative approach allows us to provide our clients with a top tier service offering that produces quality, objective-driven results across their entire wealth platform.

COMPREHENSIVE APPROACH TO MANAGING OUR CLIENTS’ WEALTH

After first gaining a thorough understanding of your financial and lifestyle goals, we will establish a strategic framework that best governs your circumstances and objectives, followed by an appropriate investment strategy in line with your risk tolerance to preserve capital and grow your wealth.

Overall our advice process will:

Understand your financial goals and objectives

Align your financial ambition and strategy

Deliver results and exceed expectations

Our investment philosophy is to combine tailored asset allocation advice with a long-term investment strategy that encompasses the objectives of the family group. We focus on generating real returns whilst employing an appropriate level of risk through a diversified portfolio of investments.